A Year of Transformation

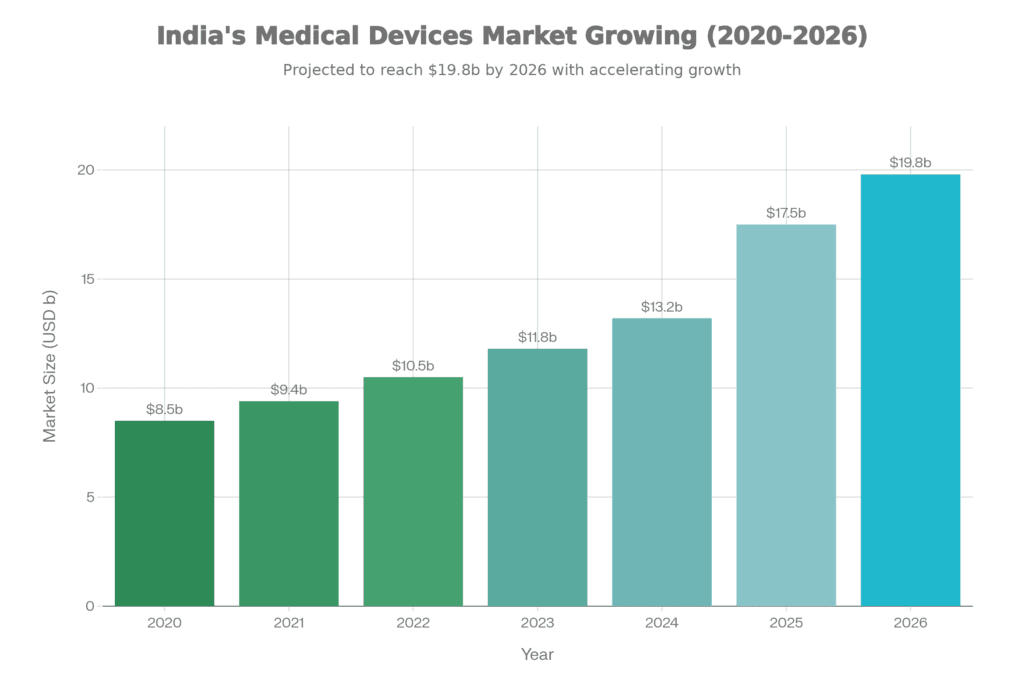

The numbers tell part of the story: the sector grew at 10-12% year-over-year, reaching a market size of USD 17.5 billion. But more importantly, something fundamental changed in how policymakers and industry leaders approached medtech. For the first time, it was recognized as a distinct sector deserving its own tailored frameworks, not just an afterthought in broader healthcare or pharmaceutical policies.

Market Growth Rate

(year-over-year expansion)

Market Size 2025

(estimated valuation)

Important Dependence

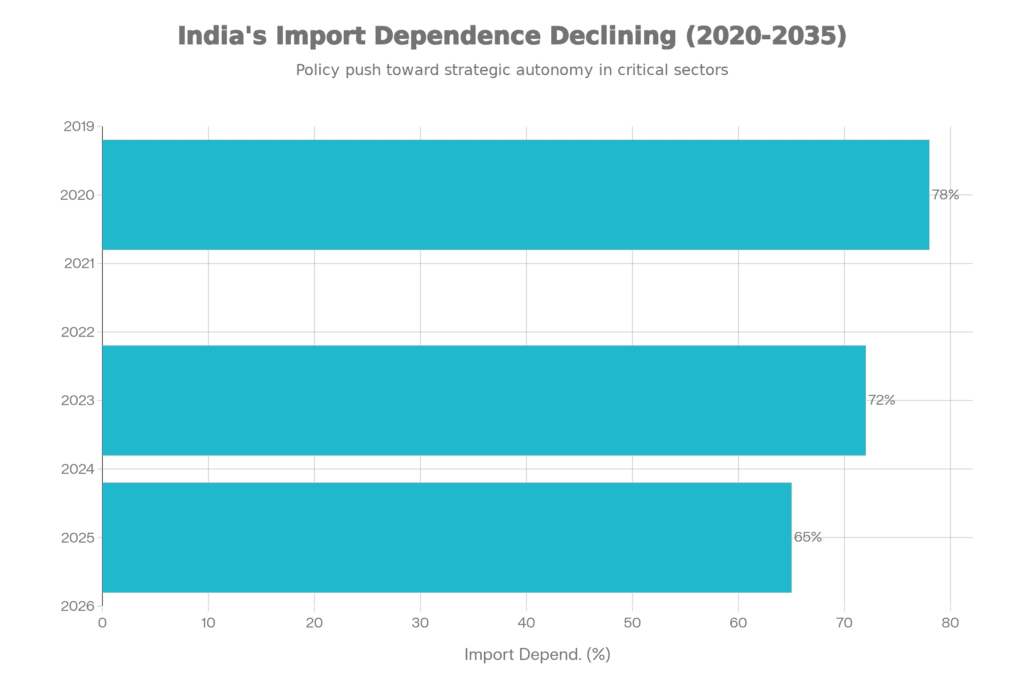

(down from 78% in 2020)

10-12%

USD 17.5B

65%

That import dependence figure is particularly interesting. Yes, we’re still importing the majority of our medical devices, but the trajectory matters. Moving from 78% to 65% in five years represents real manufacturing capacity coming online, not just incremental improvements.

🎯 Key Insight

2025 marked the year when India’s medtech industry transitioned from aspirational targets to measurable progress. The PLI scheme delivered tangible manufacturing scale, regulatory convergence accelerated with CDSCO-IMDRF alignment, and structural shifts toward localization began emerging—though policy execution gaps remain a critical constraint for 2026 momentum.

What's Actually Driving This Growth?

Steady Expansion Trajectory

The expansion didn’t happen in a vacuum. Three forces converged to create this momentum, and understanding them helps explain why 2025 felt different from previous years.

First, India’s disease burden is changing. Chronic conditions—diabetes, hypertension, respiratory diseases, and cancer—are rising steadily. These aren’t conditions you treat once and forget; they require ongoing monitoring, diagnostic testing, and therapeutic interventions. Each of these needs creates demand for medical devices, from simple blood pressure monitors to complex cardiac stents.

Second, healthcare infrastructure is finally spreading beyond metros. Tier-2 and tier-3 cities are seeing hospital expansion at rates that would have seemed impossible a decade ago. This geographic dispersion matters because it creates distributed demand centers, making local manufacturing more economically viable than ever before.

Third—and this surprised many observers—domestically manufactured products are gaining genuine acceptance. Both public and private healthcare providers are increasingly willing to source from Indian manufacturers, provided quality standards are met. This confidence didn’t exist even three years ago.

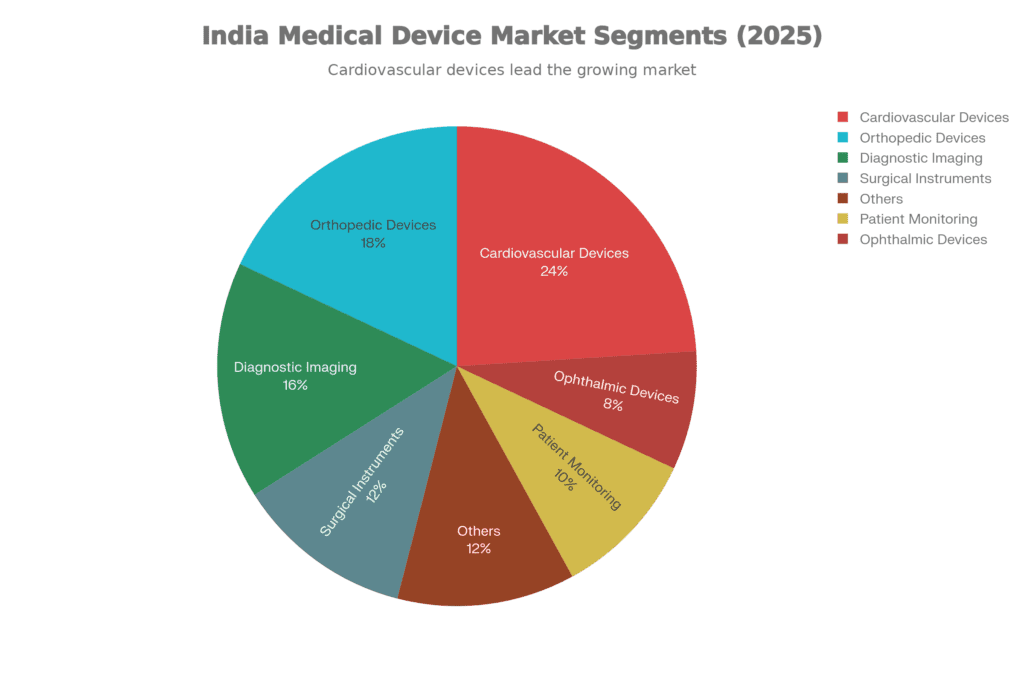

Where the Money's Actually Going

Not all medical device segments are created equal, and 2025’s market composition tells us exactly where India’s healthcare priorities lie:

- Cardiovascular Devices (24%) command the largest share, which makes perfect sense when you consider India’s cardiac disease burden. Stents, pacemakers, and diagnostic equipment dominate this segment, and here’s the encouraging part: domestic manufacturing capabilities are genuinely improving. Companies that were merely assembling imported components five years ago are now producing critical parts in-house.

- Orthopedic Devices (18%) come next, driven by factors both predictable and tragic. An aging population needs joint replacements. Road accidents create demand for trauma implants. Musculoskeletal disorders from sedentary lifestyles require surgical interventions. The PLI scheme has attracted significant investment here because the precision manufacturing required for orthopedic implants translates well to other high-value segments.

- Diagnostic Imaging (16%) represents the high-value manufacturing opportunity everyone’s chasing. MRI machines, CT scanners, ultrasound equipment—these are the devices where “Make in India” could genuinely compete globally if the ecosystem support materializes. Several PLI projects in this space moved from approval to actual production in 2025, which wasn’t guaranteed a year ago.

- Surgical Instruments & Implants (12%) might seem less exciting than imaging equipment, but this is where Indian manufacturers have built genuine competitive advantages. Precision manufacturing capabilities developed here are positioning Indian companies as credible global suppliers, not just domestic players.

- Patient Monitoring Devices (10%) represent the future. Wearables, home diagnostics, AI-enabled monitoring—this segment grew faster than any other in 2025. It’s where healthcare is heading: continuous, personalized, data-driven care that happens outside hospital walls.

End-User Market Composition

The end-user breakdown is equally revealing. Hospitals and ambulatory surgery centers still account for 70-88% of device expenditure, but clinic networks are expanding rapidly at 8.74% CAGR. This shift toward outpatient diagnostics reflects how healthcare delivery is evolving, particularly in non-metro cities where smaller facilities are more economically sustainable.

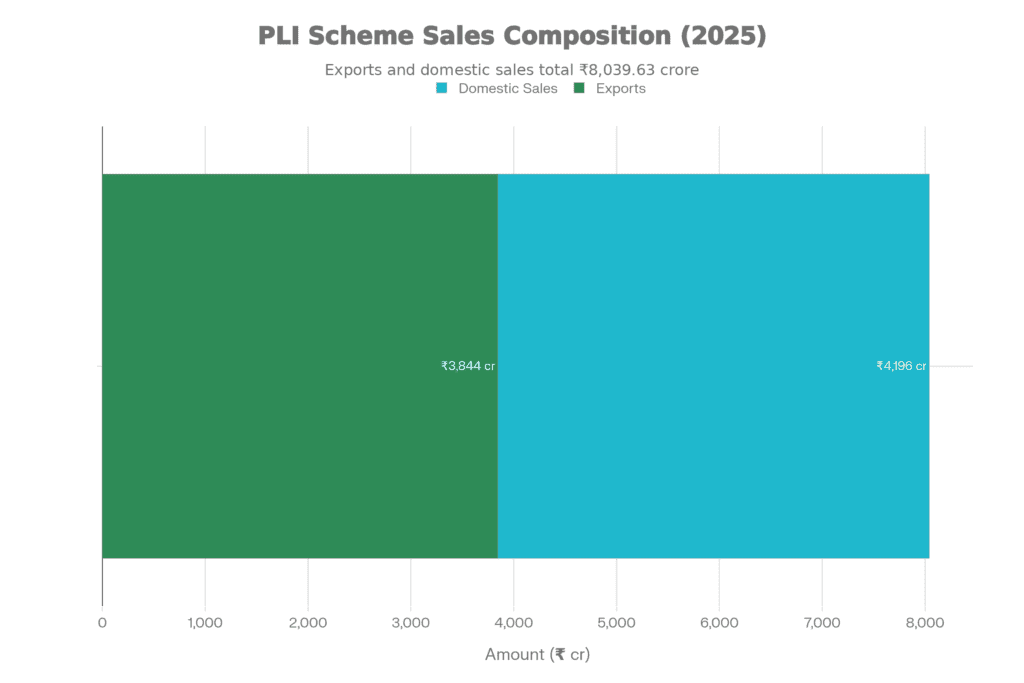

The PLI Scheme: Where Rubber Met Road

Quantifiable 2025 Outcomes

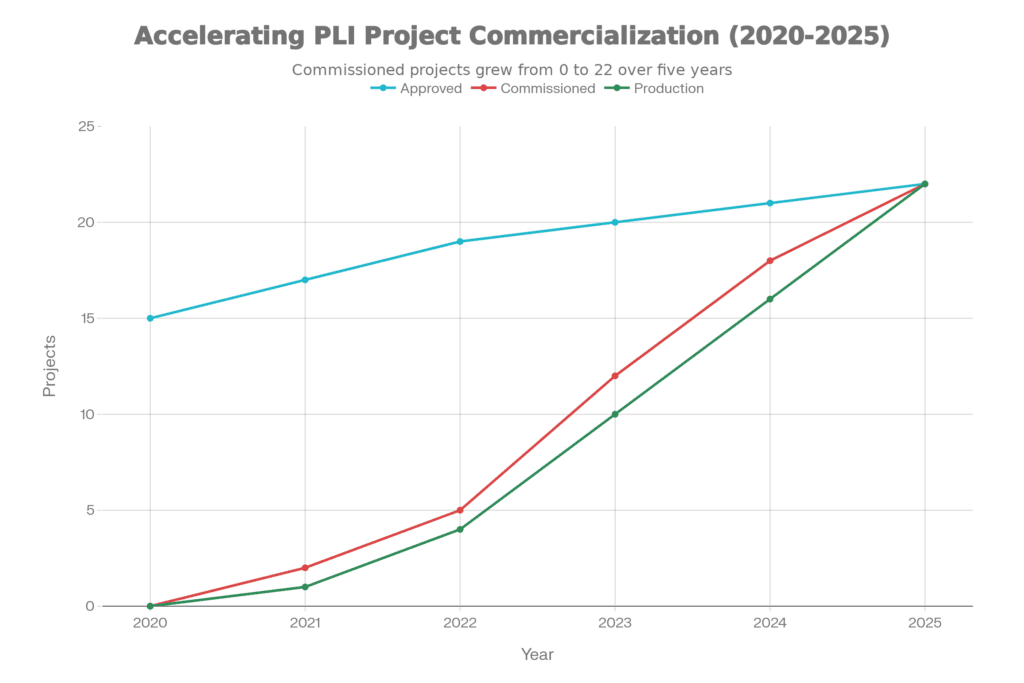

Let’s be honest about government schemes in India—many sound impressive in press releases but deliver little on the ground. The Production Linked Incentive (PLI) scheme for medical devices, launched in 2020 with Rs 3,420 crore allocated, risked becoming another example. But 2025 proved different.

Exports Generated

(Export value creation)

Projects Commissioned

(Active manufacturing)

Rs 8,040 Cr

Rs 3,844 Cr

22

Those aren’t aspirational targets—they’re actual sales from operational manufacturing facilities. Twenty-two greenfield projects transitioned from approval documents to production lines, covering everything from advanced diagnostic imaging to cardiac devices.

Project Progression & Commercialization

What matters more than the sales figures is the structural shift they represent. Companies moved from pilot-scale assembly—where you’re essentially packaging imported components—to platform-scale manufacturing where genuine value addition happens in India. The project categories tell the story:

- Advanced diagnostic imaging (MRI, CT, mammography systems)

- Radiotherapy and radiation oncology equipment

- Surgical and endoscopy instruments

- Orthopedic implants and instrumentation

- Cardiac and neurovascular devices

Quality Systems & Manufacturing Alignment

Beyond the obvious manufacturing capacity, something less visible but equally important happened: quality systems matured dramatically. The incentive structure effectively pushed manufacturers to invest in capabilities they might have delayed otherwise:

ISO 13485 certification became standard rather than optional. Advanced automation and Industry 4.0 technologies got deployed faster than anyone predicted. In-house testing laboratories emerged because waiting for third-party validation was slowing down product iterations. Supply chains got localized component by component as manufacturers realized dependence on imports undermined their competitive positioning.

Critical Caveat

While PLI delivered encouraging results, progress remained uneven across device segments. Industry executives cautioned that the scheme’s full potential remains unrealized due to conflicting measures—including broadening of Global Tender Exemption lists and continued allowance of imported pre-owned refurbished equipment. These policy contradictions offset localization incentives and created market distortions favoring imports.Here’s where the frustration creeps in among manufacturers. The government is literally paying them incentives to manufacture locally through PLI, while simultaneously making it easier to import devices through relaxed tender rules and allowing pre-owned equipment that undercuts new domestic production. It’s like encouraging someone to build a house while also subsidizing cheaper apartments next door.

Strategic Significance for Long-Term Competitiveness

The long-term significance of PLI extends beyond immediate sales targets. It demonstrated something critical: India can build scale and credibility in high-end medical device manufacturing when policy support aligns properly. But—and this is what keeps coming up in industry conversations—incentives alone won’t ensure long-term competitiveness. The next phase requires:

- Correcting inverted duty structures that make imports cheaper than domestic production

- Ensuring faster regulatory approvals through predictable pathways

- Strengthening testing infrastructure with proper NABL accreditation

- Providing assured market access through transparent, preference-based procurement

- Addressing raw material import costs and helping build component ecosystems

The Regulatory Revolution Nobody Noticed

CDSCO-IMDRF Alignment: Global Best Practices Integration

While PLI grabbed headlines, arguably the most significant structural development happened quietly in regulatory corridors: CDSCO’s association with the International Medical Device Regulators Forum (IMDRF).

For anyone outside the medical device industry, this might sound bureaucratic and boring. It’s neither. This alignment signals India’s commitment to converging with global regulatory best practices, which fundamentally changes the calculus for manufacturers deciding where to establish production capacity.

Four Pillars of Regulatory Convergence

Four Pillars of Regulatory Convergence

- Device Classification Systems: Risk-based frameworks now harmonize with international standards, meaning a device classified as Class C in Europe gets similar treatment in India rather than facing arbitrary reclassification.

- Clinical Evidence Requirements: Here’s the big one—CDSCO started accepting internationally generated clinical data. Previously, manufacturers often had to repeat clinical studies already conducted in the US or Europe, adding years and millions to product development timelines. That redundancy is reducing.

- Post-Market Vigilance: Real-world performance monitoring and adverse event reporting now align with IMDRF guidelines, creating consistency for companies operating across multiple markets.

- Quality Management Systems: ISO 13485 convergence means manufacturers can design quality processes that satisfy both Indian and international regulators simultaneously, rather than maintaining parallel systems.

The practical impact showed up early in 2025 when CDSCO reclassified 553 devices using risk-based frameworks:

| Risk Classification | Device Count | Regulatory Pathway |

|---|---|---|

| Class A (Low Risk) | 28 devices | Notification / Exemption |

| Class B (Moderate Risk) | 153 devices | Registration + Approval with Technical File |

| Class C (High Risk) | 151 devices | Clinical Evaluation/investigation + Approval |

| Class D (Highest Risk) | 221 devices | Clinical Evaluation/investigation + Approval |

This isn’t just administrative reshuffling. Lower-risk devices got streamlined pathways, reducing time-to-market. Higher-risk devices got appropriate scrutiny without unnecessary bureaucracy. The result? Predictability, which is what manufacturers need most when planning multi-year, multi-crore investments.

Digital Transformation of Regulatory Pathways

CDSCO also launched several digital mechanisms that reduced what industry folks call “compliance friction”:

- Risk Classification Module (November 2025) provides a functional system for classifying devices not yet on published lists, eliminating months of uncertainty about which regulatory pathway applies.

- Subsequent Importer Mechanism (September 2025) streamlined imports for devices already approved for one importer, preventing redundant reviews.

- Neutral Code System: auto-generates export codes instead of requiring manual applications, removing a significant bureaucratic bottleneck.

- Medical Device Software Guidance (Draft): (still in draft) creates frameworks for AI-enabled, cloud-hosted applications, acknowledging that medical devices increasingly consist of software as much as hardware.

BIS Harmonization & Certification Acceleration

Meanwhile, the Bureau of Indian Standards (BIS) advanced harmonization of Indian standards with ISO and IEC benchmarks throughout 2025. By December, 214 critical devices

- Automated external defibrillators (AED)

- Mechanical ventilators

- Anesthesia machines

- Phototherapy units

- Blood pressure monitors

- Suction machines

The key improvement: these certifications now align with international standards, reducing duplication for manufacturers serving both domestic and global markets.

Rationalization of Compliance Requirements

- Redundant Quality Control Orders from the pre-2015 regulatory regime got eliminated, removing overlapping requirements that confused everyone.

- Legal Metrology requirements got streamlined, reducing labeling documentation burdens.

- Minor compliance infractions got decriminalized—meaning companies now face corrective action frameworks rather than criminal penalties for non-critical gaps.

- Product reviews moved online with digital submission and tracking, replacing manual processing that could delay approvals for months.

Regulatory Milestone

The convergence with IMDRF and acceleration of digital pathways represent a paradigm shift. Manufacturers can now design products with global regulatory frameworks in mind from inception, reducing product development timelines and enabling simultaneous pursuit of Indian and international approvals. This structural change improves India’s attractiveness as a manufacturing destination for companies targeting Asian markets.

Manufacturing Reality Check: Progress With Asterisks

Emerging Signs of Structural Shift

Industry leaders who spoke candidly about 2025 used phrases like “beginning of a meaningful shift” rather than “transformation complete.” That caution matters because while the direction is right, the journey remains long.

Import dependence dropped from 78% (2020) to 65% (2025) — significant progress, but also a reminder that nearly two-thirds of medical devices used in India still come from abroad. The optimistic interpretation: the trajectory points toward continued improvement if policy consistency holds. The realistic interpretation: structural barriers remain formidable.

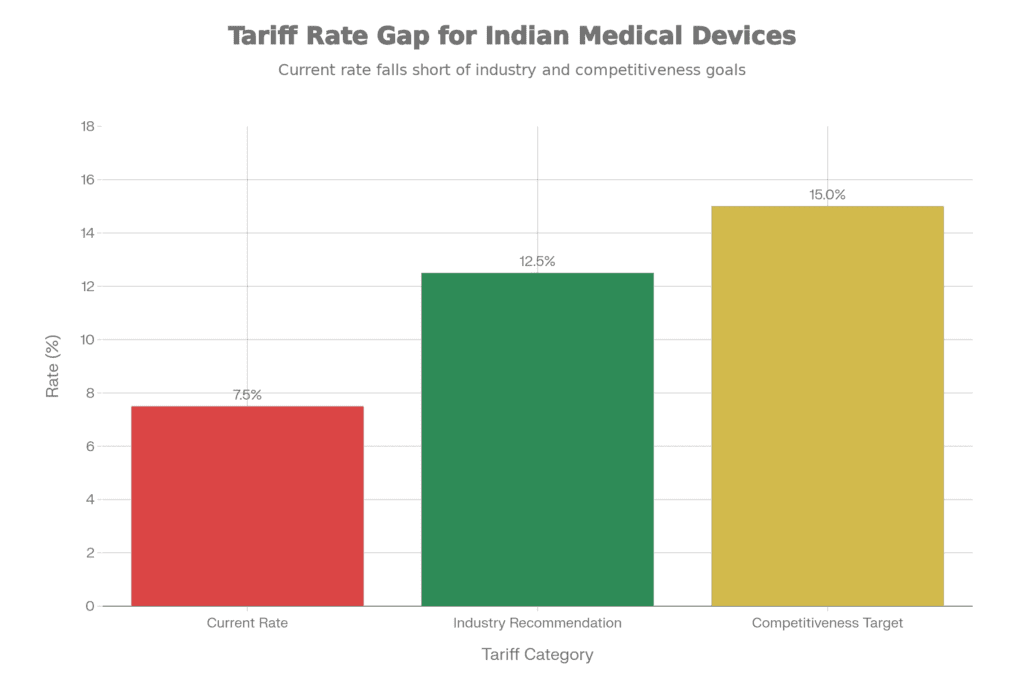

One barrier towers above others: inverted duty structures. This technical-sounding term conceals a simple absurdity—it’s cheaper to import finished devices than to manufacture them domestically using imported components.

Medical Devices Tariff Rates: Current vs. Recommended

Gap between current 7.5% tariff and industry recommendations for 10-15% adjustment to enhance competitiveness

Current tariff: 7.5% | Industry recommendation: 10-15%

Here’s how the math plays out: A finished medical device imported into India faces a 7.5% tariff. But an Indian manufacturer importing components to build that same device faces tariffs on each component, plus GST cascading through the supply chain, plus the reality that domestic labor and overhead costs aren’t necessarily lower than Chinese or Malaysian alternatives. The result? The domestic manufacturer can’t compete on price despite often matching or exceeding quality.

Small and medium enterprises feel this squeeze most acutely. Large multinationals can absorb the margin pressure or benefit from transfer pricing structures. SMEs can’t. Industry executives estimate—and this number came up repeatedly—that correcting tariffs to 10-15% could unlock INR 5,000+ crore in domestic manufacturing investments over the next three years. That’s not happening at 7.5%.

Regional Manufacturing Hubs Development

Geographic concentration of manufacturing remained pronounced in 2025, with South India maintaining approximately 34% of national market share:

- Bengaluru: emerged as the hub for diagnostic imaging, surgical instruments, and orthopedic devices—leveraging its existing precision manufacturing ecosystem and engineering talent pool.

- Chennai: focused on cardiovascular devices and medical-grade materials, building on decades of automotive and precision component manufacturing experience.

- Hyderabad: attracted advanced imaging systems and radiation oncology equipment manufacturers, partly due to proactive state government support and existing pharmaceutical infrastructure.

- Pune: strengthened its position in orthopedic implants, surgical instruments, and precision components, benefiting from its automotive supply chain sophistication.

This concentration isn’t necessarily problematic—clusters create supplier ecosystems and specialized talent pools. But it also creates vulnerabilities and limits opportunities for states trying to develop their own medtech capabilities.

Infrastructure Execution Gap

Medtech parks, testing laboratories, and skills development initiatives remained in promise-to-delivery transition phase. While government announcements positioned these as strategic priorities, actual on-ground execution lagged timelines. This infrastructure gap represents the most critical bottleneck for 2026 acceleration.This infrastructure gap frustrates manufacturers more than almost anything else. Testing labs get announced with fanfare—then take years to become operational. Medtech parks get inaugurated—then lack basic utilities for months. Skills development programs get launched—then struggle to find industry partners for practical training. The problem isn’t lack of intention; it’s execution capability within government systems designed for different priorities.

What 2026 Actually Needs to Deliver

Critical Shift Requirement

Industry leaders who lived through 2025’s progress and frustrations were remarkably consistent about what 2026 must deliver. Not aspirational visions for 2030—specific, measurable actions in the next twelve months.

Five Strategic Imperatives for 2026

- Tariff Reform: Raise tariffs to 10-15% from current 7.5% to correct cost disadvantages that make domestic manufacturing uncompetitive despite quality improvements.

- Transparent Labeling: Mandate domestic value addition disclosure on devices, enabling informed procurement decisions and actually enforcing “Make in India” preferences that currently exist only on paper.

- Infrastructure Delivery: Accelerate medtech parks, testing labs, and skills development from promises to operational status—with specific commissioning dates and accountability for delays.

- Policy Consistency: void sudden regulatory changes and maintain predictable enforcement of procurement preferences instead of undermining them with contradictory exemptions.

- Component Ecosystem: Support supply of critical raw materials and components through targeted incentives rather than assuming manufacturers can magically develop entire supply chains independently.

These aren’t revolutionary ideas. They’re practical, implementable interventions that address specific bottlenecks manufacturers face daily. The frustration in industry conversations stems from seeing clear solutions that require bureaucratic coordination more than additional budget allocation.

Growth Catalysts for 2026-2028

Several trends position the sector for accelerated growth if these foundations get addressed:

Chronic Disease Burden Expansion

guarantees sustained demand growth. India’s rising rates of diabetes, hypertension, respiratory diseases, and cancer create expanding markets for diagnostic and therapeutic devices. Home diagnostics, minimally invasive therapies, and AI-enabled monitoring devices will capture much of this growth—segments where Indian manufacturers can genuinely compete.

Healthcare Infrastructure Development

continues spreading beyond metros. Secondary and tertiary care facilities in tier-2 and tier-3 cities create distributed demand centers that support local manufacturing ecosystems economically. This geographic dispersion reduces logistics costs and improves supply chain resilience naturally.

Affordability-Driven Innovation

represents India’s genuine competitive advantage. The “affordability imperative”—delivering quality products at 30-50% lower price points than Western manufacturers—positions Indian companies to develop cost-optimized designs meeting global standards. This capability gap attracts multinational manufacturing footprint investments and opens emerging market export opportunities.

Strategic Policy Announcements

came from Health Minister JP Nadda, who announced four schemes supporting ecosystem development. The catch: they require budget sanctioning and actual disbursement in 2026:

| Scheme | Focus Area | Expected Impact |

|---|---|---|

| Marginal Investment Support | SME capacity expansion | INR 500-1,000 crore investment unlocking |

| Skilling & Technical Training | Workforce development | 50,000+ skilled personnel by 2027 |

| Clinical Studies Support | Regulatory evidence generation | Faster approvals, reduced development timelines |

| Infrastructure Development | Testing labs, medtech parks | Operational hubs in 5+ states by 2027 |

The question industry observers keep asking: Will these schemes actually get implemented, or join the long list of well-intentioned announcements that never materialize?

The Risks Nobody Wants to Discuss Publicly

Every industry presentation emphasizes opportunities and downplays risks. But candid conversations with manufacturers reveal three concerns that could derail 2026’s momentum:

Foremost Risk: Policy Inconsistency

This isn’t abstract—it’s the lived experience of manufacturers who made multi-year investment decisions based on policy frameworks that then changed without warning. Sudden regulatory modifications, uneven enforcement of procurement preferences, and unresolved GST and tariff anomalies undermine investor confidence more than any external factor.The Global Tender Exemption list keeps expanding, allowing imported devices to bypass local sourcing preferences. Pre-owned refurbished equipment imports continue flowing despite directly contradicting PLI objectives. These aren’t theoretical contradictions—they represent real market share losses for manufacturers who invested based on government assurances that local production would get preference.

Secondary Risk: Structural Import Dependence

Even with perfect policy execution, India cannot immediately manufacture everything domestically. Critical inputs—advanced alloys, specialty polymers, microelectronics—come from supply chains decades in development. Chinese and European suppliers dominate these segments with scale and cost structures Indian suppliers won’t match quickly.This reality requires pragmatic, phased localization strategies rather than aspirational targets. Supply chain vulnerabilities for these inputs pose near-term bottlenecks that domestic suppliers simply cannot address immediately at required scale and competitiveness. Acknowledging this doesn’t mean accepting permanent dependence, but it does mean planning realistic timelines.

Tertiary Risk: Quality vs. Affordability Trade-offs

India risks becoming a dumping ground for low-quality imports and refurbished devices marketed as “affordable healthcare solutions.” Without rigorous quality-based regulation and ethical marketing enforcement, the entire ecosystem’s credibility suffers.When a hospital uses a substandard device that fails during surgery, the resulting perception damage affects all Indian manufacturers, even those meeting international quality standards. This collective reputation risk requires industry self-regulation and government oversight that goes beyond paperwork compliance.

The 2035 Vision That Could Actually Happen

Despite near-term risks and frustrations, something shifted in 2025: believability. Industry executives who previously dismissed “medtech hub” rhetoric as aspirational now articulate specific pathways to get there.

With consistent reforms and genuine public-private collaboration, India can realistically:

- Reduce import dependence below 30% over the next decade (from current 65%)

- Establish itself as a trusted global medtech hub offering quality products at competitive price points

- Create 200,000+ skilled jobs spanning design, manufacturing, and specialized services

- Achieve USD 50+ billion market valuation by 2035, positioning among top-5 global manufacturing destinations

These aren’t fantasy projections—they’re extensions of trajectories already visible in 2025 data, assuming policy consistency and infrastructure execution improve.

Strategic Coherence

India’s current policy trajectory reflects an integrated vision spanning Design in India, Make in India, Skill in India, and Heal in India—covering industrial development, innovation, workforce capability, and patient access. This holistic approach, if executed with consistency, positions the sector for sustainable, inclusive growth.The coherence matters because medtech success requires multiple elements working together. You can’t just manufacture devices without designing innovations that meet India’s specific needs. You can’t scale production without skilled workers throughout the value chain. You can’t build sustainable businesses without accessible healthcare systems that actually use domestically produced devices.

What Actually Needs to Happen: Specific Recommendations

For Policymakers

- Immediate (Q1 2026): Announce tariff correction to 12.5% with a clear roadmap toward 15% by Q4 2026. Don’t just announce—actually implement with transparent timelines. This single action addresses SME cost disadvantages more effectively than any subsidy program.

- Q2 2026: Implement domestic value addition labeling requirements that enable informed procurement decisions. Healthcare providers need to know what percentage of a device’s value was actually created in India versus merely assembled from imported components.

- Q2-Q3 2026: Resolve Global Tender Exemption anomalies and discontinue allowance of pre-owned refurbished imports. Stop undermining PLI objectives with contradictory policies that favor imports.

- Ongoing: Establish high-frequency regulatory-industry dialogue forums—monthly, not annual—that prevent sudden policy reversals and create transparency about planned changes.

For Industry

- Supply Chain Resilience: Develop phased, realistic strategies for reducing imported raw material dependence through supplier development programs rather than assuming overnight transformation.

- Quality Investment: Strengthen quality management systems and in-house testing capabilities continuously, not just to meet minimum compliance but to genuinely compete with international benchmarks.

- Talent Acquisition: Collaborate actively with NIPERS, IITs, and nursing colleges to develop technical and clinical workforce pipelines instead of complaining about talent shortages.

- Innovation Focus:Leverage PLI scheme for high-technology projects while simultaneously building domestic component ecosystems through strategic supplier partnerships.

- Ethical Marketing: Maintain high quality standards and transparent communication to build consumer and provider trust that benefits the entire sector rather than pursuing short-term gains through corner-cutting.

For Healthcare Providers

- Domestic Procurement: Gradually increase sourcing from PLI-backed manufacturers, providing the market access that supports ecosystem maturation.

- Quality Assurance: Implement rigorous quality verification for domestically sourced devices through systematic testing and feedback, building confidence in local manufacturing.

- Skills Transfer: Collaborate with manufacturers for training programs on device usage and maintenance optimization, creating value beyond the procurement transaction.

The Bottom Line: Momentum Meets Reality

India’s medtech sector stands at an inflection point where momentum is genuine but fragile. The 2025 achievements demonstrate that progress is possible: 10-12% market growth, Rs 8,040 crore in PLI sales, regulatory convergence with IMDRF, and visible structural shifts toward localization.

But these gains aren’t self-sustaining. 2026 will test whether progress can accelerate into durable momentum or stall under policy inconsistencies and structural constraints that remain unaddressed.

The industry consensus couldn’t be clearer: policy execution must match policy ambition. Tariff correction, transparent labeling, infrastructure delivery, and consistent regulatory frameworks aren’t optional enhancements—they’re prerequisites for realizing India’s medtech potential.

With targeted interventions across these priority areas, India can realistically reduce import dependence below 30% over the next decade and establish itself as a trusted global medtech hub. The sector’s trajectory is logical and achievable, harnessing domestic innovation capabilities and international manufacturing standards while strengthening resilience and competitiveness.

The foundation is set. The PLI scheme proved manufacturing scale is possible. Regulatory convergence demonstrated international credibility is attainable. Market acceptance showed domestic products can compete on quality.

What happens next isn’t predetermined—it depends on choices made in the next twelve months. Policy consistency matters more than new schemes. Infrastructure execution matters more than fresh announcements. Following through on existing commitments matters more than articulating new visions.

The opportunity is real. The pathway is clear. The question is simply whether execution will match intention. 2025 showed it’s possible. 2026 will show whether it’s sustainable.